In our previous article ‘Investing in Dutch Tech companies: Takeaway’ we took an initial look at Thuisbezorgd.nl after going public. Now a year later the Dutch food delivering company, active within Europe, has released their annual report for 2017 with their latest key performance indicators. It has also released their Q2 2018 Trading update.

Within this article we will look through some interesting facts mentioned in the annual report and we will wrap it up with our opinion about the company’s future.

About takeaway.com

The Dutch food delivering company, started in 2000, is active in The Netherlands, Germany and other European countries like Belgium and Austria. It recently acquired existing businesses in Eastern Europe. It provides an online platform where customers can order food directly from the restaurants they love. Thuisbezorgd.nl also provide delivery services (staff and material) for companies who do not have their own. The company is directly competing with Foodora and Uber Eats.

We will begin looking at the overall performance of the company by looking at their finances.

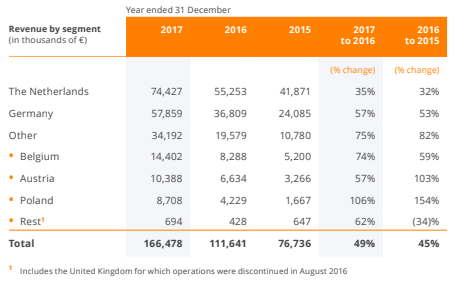

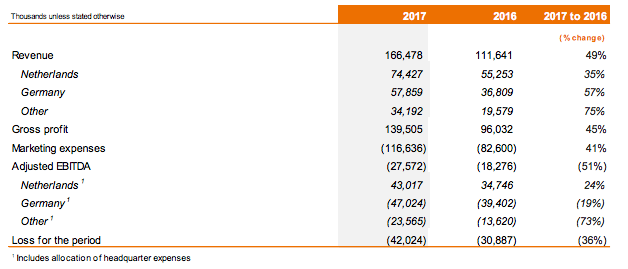

The amounts are mentioned in thousands of €

Revenue

The company had a total revenue increase of 49% compared to 2016. The overall total revenue increased from €111,641 to €166,478.

Profit

As previous years Takeaway.com is not making any profit. Their total loss increased from €30,887 to €42,024.

Marketing budget

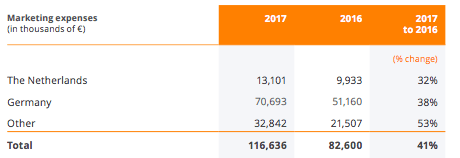

Their marketing expenses increased from €82,600 to €116,636.

Company results

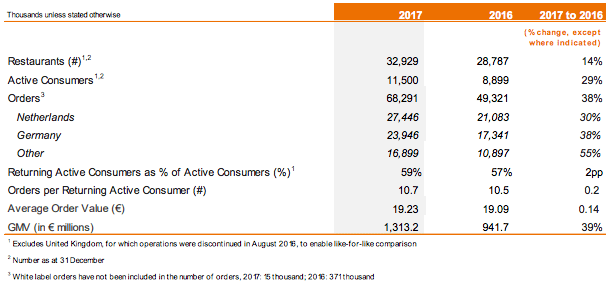

Furthermore, will be looking at the overall results of the company. The values mentioned are in thousands.

Total amount of orders

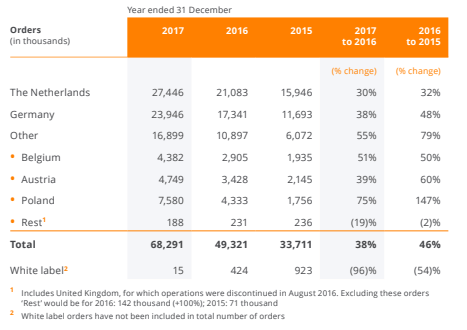

The total amount of orders placed on their site increased by 38%. The total amount of orders increased from 49,321 to 68,291.

Total restaurants available on the platform

Also, the number of restaurants using Takeaway.com increased slightly with 14%. The overall increase was from 28,787 to 32,929.

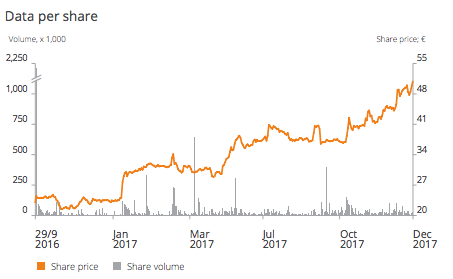

Share price performance

The stock price has increased from €23 to roughly €48 since its initial release during the end of September 2016.

Challenges

- For a lot of European companies, the new GDPR rules are putting a lot of new responsibilities concerning privacy of the users on their shoulder. The policies are specified but the implementations are still open for interpretation.

- As a technology company, IT is their core business. Having day to day operations and also preparing against any security threats can a be a huge challenge for the company.

- Takeaway’s current strategy is gaining market dominance, and this involves investing in marketing.

- The company relies on selling volumes. The more meals are being ordered the better the company performances. This also puts a huge challenge on the company.

Conclusion

For surviving in this high competitive market, the first step would be gaining market leadership. Sustainable profitability is only achievable from a position of market leadership. Take-away.com needs to be on top of their customers mind for brand awareness.

We believe that this Dutch company has a really good chance at securing this goal as a leader within the European market and is also a good option for investment.